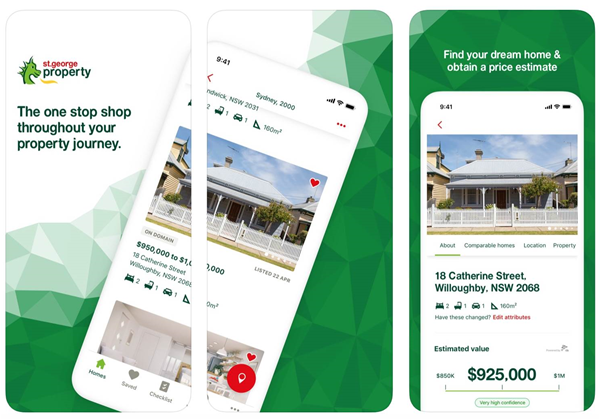

Westpac has launched a beta version of a new app that can be used to find properties on the market, and estimate the price and financial impact of purchasing them.

The app, called St.George Property, was released to the App Store last week.

It was touted as the “first product out of the Westpac Co.lab” - a co-innovation space where “Westpac and start-ups sit alongside each other to work on joint propositions”.

“The Co.lab is an extension of Westpac’s existing innovation spaces with a unique focus on building market ready solutions in collaboration with startups,” the bank says on its website.

Co.Lab director Maja Enander suggested in a brief post that the property app’s creation provided a model for future work out of the innovation space.

“The project has paved the path for new ways of working enabling us to better partner with fintechs moving forward,” she said.

“The app is hosted on AWS cloud with property price estimates from a previous Westpac fueld winner called InsightsDataSolutions (IDS).”

Fueld is described as a “data-focused accelerator” run as a partnership between Westpac, Stone & Chalk, Data Republic and Westpac’s venture capital fund Reinventure.

Enander said that the property app is designed to connect “search, affordability and lifestyle.”

“Whether you’re looking as a first timer, or you’ve set your sights on your dream home, St.George Property could ignite your house hunt with simple search features, price estimates based on recent sales and suburb insights,” the bank says on the Apple app store.

“We’ll also help you feel better prepared, outlining the full cost of buying, including the potential impact to your lifestyle.”

The app requires users to create a log-in and to confirm their email address before it can be used.

Among its features are that it can alert users to properties that match their criteria, and show a price estimate “based on comparable properties” and “market insights into suburb performance, including whether it’s a buyers or sellers market”.

It also presents users with a checklist of things that need to happen to complete the purchase of the property.

Westpac is far from alone in seeking a property-based information tie-up.

Back in 2017, NAB and REA Group - the owner of realestate.com.au - partnered to allow consumers to get online conditional approval for a home loan, that they can could then use as they searched for property.

A St.George spokesperson did not return iTnews' calls or emails.

.jpg&h=140&w=231&c=1&s=0)

_page-0001_(1).jpg&w=100&c=1&s=0)

Integrate

Integrate

.jpeg&h=271&w=480&c=1&s=1)